Canadian Interest Rates

September 12, 2017

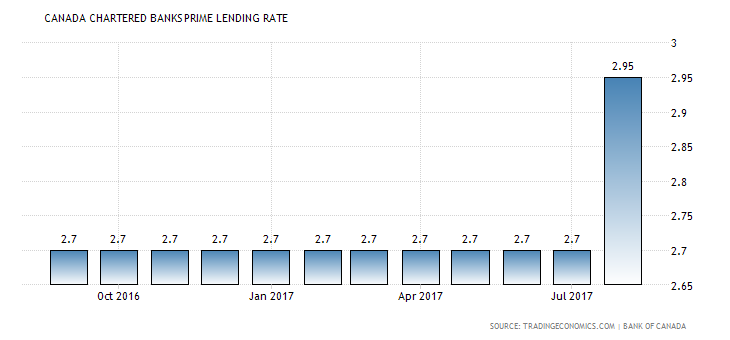

Well, it happened and is going to happen again whether we like it or not. Interest rates went up twice this summer and the big bank of Canada left the door wide open to increase them (interest rates) again before the year is over.

Did you also notice that the Bank’s two rate hikes this summer erase the two cuts it implemented in 2015 in response to the oil-price shock. So, we are basically back to 2015 interest rates with the potential to go higher.

Interest Rates & Fluctuation Means:

Generally speaking – Lower interest rates stimulate the economic activity. Lower interest rates make it cheaper for firms and consumers (people like you and us) to borrow.

Higher interest rates typically have a cooling effect on growth, helping to keep inflation in check. However, higher interest rates are now also going to affect your purchasing power as you now have to pass a stress test before you can qualify for a home mortgage.

For homeowners with variable-rate mortgages, also known as adjustable-rate mortgages, you will immediately feel the increase in the overnight rate increase. If you can get locked into a fixed interest rate – it may be a great idea to do so. (Please talk to your bank or mortgage advisor before you make any decisions).

For homeowners who have locked in a fixed-rate mortgage, nothing will change until the fixed term ends and it’s time to renew. However, when you go to renew your mortgage you will notice an increase.

“Absent a significant shock, [Wednesday’s] rate increase will be part of a larger and longer march towards rate normalization,” Toronto-Dominion Bank economist Brian DePratto said in a research note.

What Should I Do?:

We cannot stress this enough – Anyone currently looking for a home should get a pre-approval that guarantees today’s fixed rates for 120 days.

If you are looking to secure a mortgage it is wise to keep in mind that each lender has their own qualifying criteria.

Certain applications may not meet one lender’s qualifying guidelines; however, a second mortgage lender may not have any issues with the application.

Keep an open mind and look at both a bank and a mortgage broker because brokers have access to many different lenders so there’s a higher chance of finding a lender who will provide financing for you. If you don’t meet your bank’s guidelines, the application may be declined.

If we can help you in any way, please do not hesitate to contact us!