Should You Buy Now? How Much Home Can You Afford?

January 21, 2016

This Guest Blog Brought To You By: Shawna MacDonald, Owner of The Mortgage Associates.

Have you ever wondered how much you could afford if you were to purchase a home?

Buying a home is likely going to be your biggest investment so where do you start. We asked Shawna MacDonald the owner of TMG The Mortgage Associates and awarded Canada’s top broker for her thoughts.

Home Ownership:

Perhaps the most important step in purchasing your first home is being confident you can afford it. A mortgage broker can simplify an often-stressful situation and send you out shopping with confidence.

The first step is to contact a mortgage broker who can analyze your personal situation including your annual income & current debts and give you a pre-approval amount that would be comfortable for you. Often you can be pre-approved for much more than you are comfortable with.

There are also a number of other items to consider such as rate and product. Again a mortgage broker can assist with these decisions as it is not always a rate discussion. An example I often refer to is the cheapest nor the most expensive car is always the best fit for you.

Affordability:

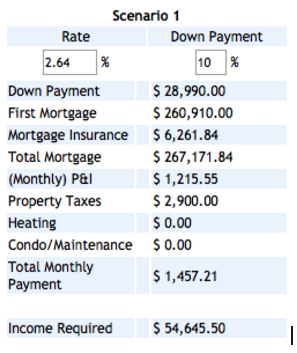

So if we have a closer look at affordability. Specifically, the Plan “D” 3 bedroom Arbutus home is selling for $289,900. What would the annual income need to be?

If we base this scenario on the most common mortgage, a 5 year term & 25 year Amortization, annual taxes of $2,900/yr, a 10% down payment and competitive rate of 2.64%. One would need to have an annual income of approximately $55,000/year. The monthly payments would be $1,450/month.

Now if you consider that the average 3 bedroom rental in Saskatoon is approximately $1200/month according to the Saskatoon Rental board one could own their own home for as little as $200 more per month.

So instead of renting and throwing away $72,000 over the next 5 years you can invest that into your home. Not paying off someone else’s mortgage.

Should I Wait:

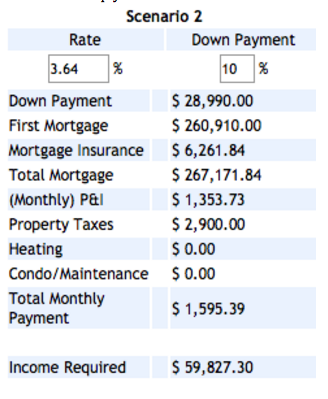

People often query if they should wait and save more money. Although this can be a difficult question to answer one may want to consider how this scenario changes if rates move up ~ as they are historically low right now. If rates were to increase to 3.64% and everything stays the same the annual income required would also rise to $60,000 or simply you would need a $5000 raise in the same time frame. This doesn’t consider the amount of rent you have wasted.

So in conclusion, some may think it is better to rent or to wait but based on our analysis it may be better to act while rates are historically low. Again a mortgage broker can help you understand what works best for your situation. Please do not hesitate to contact us if you have questions, need support or are looking for a mortgage.