Interest Rates & Affordability – Are You Ready

October 19, 2017

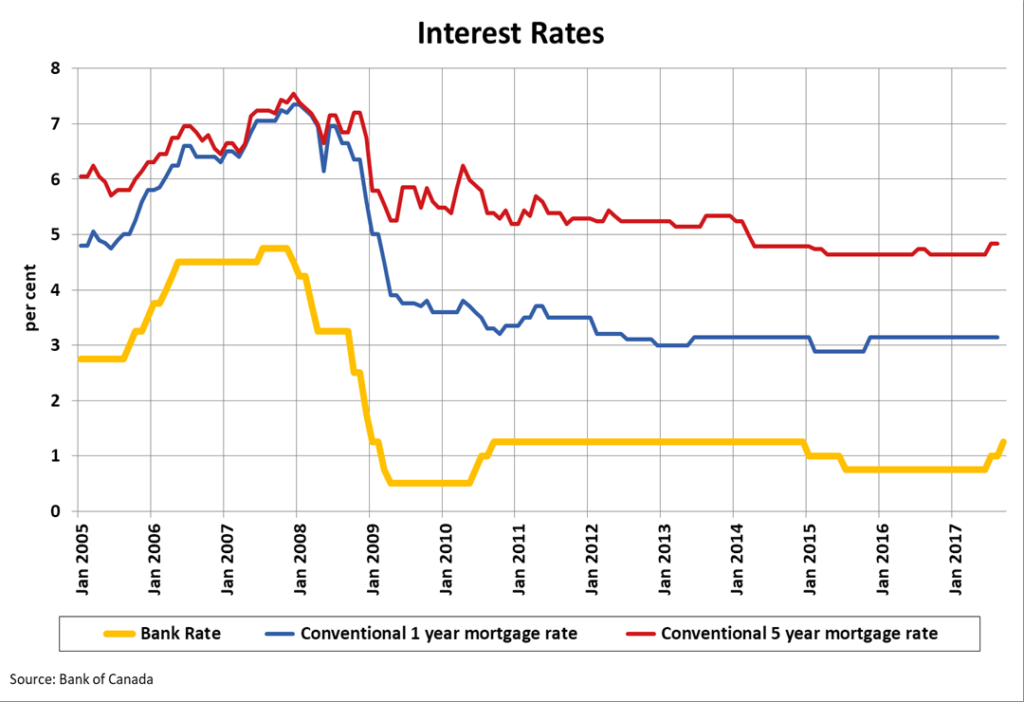

We’ve had record-low interest rates, for quite some time now. If you were able to get a home before the new interest rate increase and before the new stress test was implemented by the bank, consider yourself lucky – you had more purchasing power.

Interest Rates:

Homeowners now need to prepare themselves for the inevitability of rising interest rates, again. (If you have already been to the bank they usually honour your rates for 120 days. So, if you are thinking of buying a home soon, it would be great to get into the bank and secure financing).

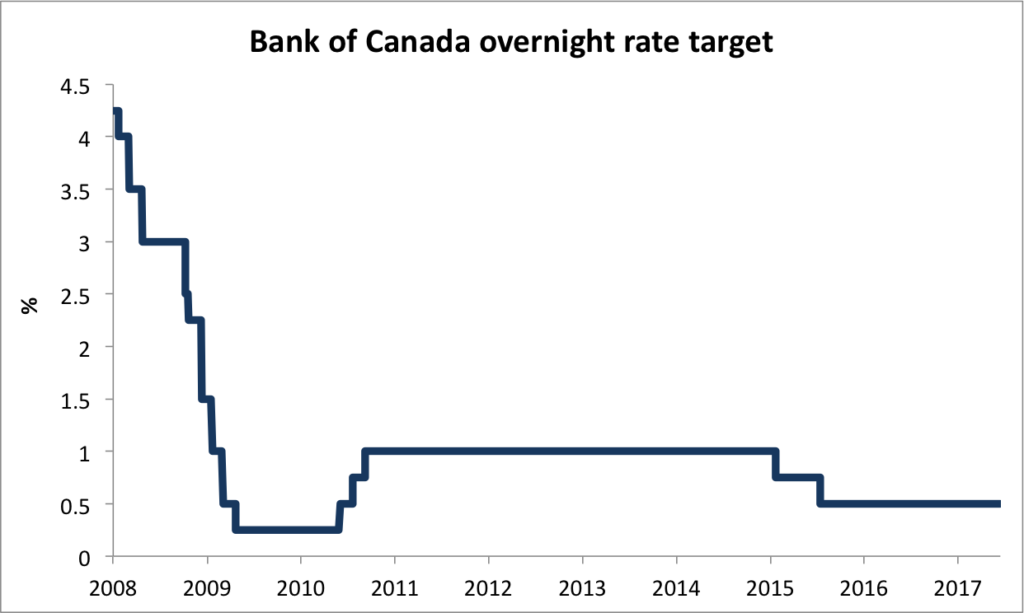

In July, the Bank of Canada raised their benchmark interest rate by 25 basis points. This was their first increase in almost seven years. “The expectation is that the Bank of Canada will continue to increase interest rates as Canada’s economy heats up, and lenders will continue to pass on the full cost of those hikes to consumers.” Huffington Post.

Variable Interest Rates:

If you currently have a variable-rate mortgage you will already be dealing with an adjustment in your interest rate. If you are in a locked-in or fixed-rate mortgage, you won’t be affected until it’s time to renew your mortgage

Next Steps For Home Ownership With New Interest Rates:

If you are currently in the market for a new property, you will need to review your budget to re-assess the price of a home you can afford. You need to remember the new down payment rules. You also have to take into consideration stress test on mortgages – and new rules will take effect in January 2018. “Even homebuyers who don’t require mortgage insurance because they have a down payment of 20 per cent or more will have to prove they can continue to make payments if interest rates rise.” Global News

We suggest you talk to your bank or mortgage specialist in order to understand your affordability. You may need a larger down payment or you may have to consider purchasing a less expensive house or condo.

Once you know what you can comfortably afford it’s time to start house hunting. And it just so happens, we have a home in every price range for every family situation.