How Will The New Mortgage Rules Affect You

November 03, 2016

We are sure you have heard that there are new mortgage rules that were put in to effect – as of October 17th. Did you know these new mortgage rules affect all new insured mortgages and that one of the “new rules” includes a stress test?

The new mortgage rules were implemented in order to ensure that homebuyers (like yourself) can continue to afford their mortgage payments if their interest rates were to increase.

Previously, when applying for a mortgage you would be approved based on the current interest rate. Currently, when applying for a mortgage, you will be put through a “stress test”. This test will put you through a 5 year fixed rate at an interest rate of 4.64%.

What Does That Mean In Terms Of Payments?

In terms of payments – you will still pay the same amount that you were approved for based on the current interest rate. Assuming that you obtain a mortgage loan with an interest rates of 2.49%, and you were to buy a Morris home in The Meadows at $349,900 your monthly payments including the CMHC mortgage loan insurance will be $1,541. However, when you are approved for your mortgage, your banker or your lender will need to ensure you can make payments at an interest rate of 4.64% making your monthly payments $1,907.41.

Believe it or not, this is actually good for you and your family. This safe guard ensures that you and your family will still be able to afford your mortgage if banks change their interest rates. If you can comfortably afford your mortgage you will be better prepared for the future.

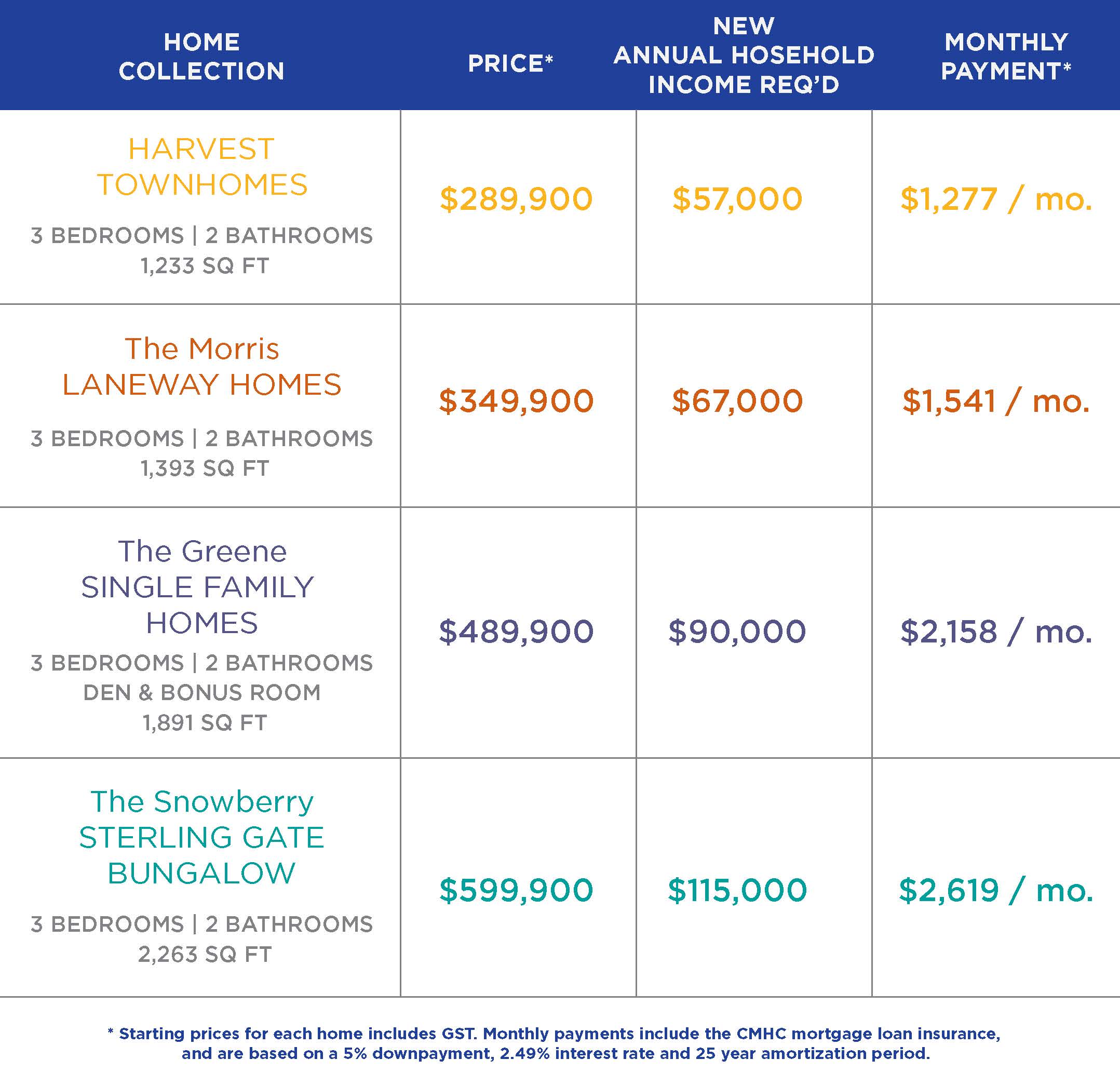

To further demonstrate these changes, we’ve put together little table for you regarding our homes and the new levels of household income you will need to be at, in order to afford a certain type of home.

If you have questions, concerns or comments, please call us. We are here to help. Or please contact your Mortgage Broker or Shawna MacDonald from The Mortgage Associates at shawnamacdonald@shaw.ca or 306.384.6353 for more information.