You’re Closer To A Down Payment Than You Think

October 27, 2016

Saving for a downpayment on house can be a discouraging process.

It can feel as though you will never have enough money for a down payment. For several first-time buyers, saving for a down payment is the most difficult step in the home-buying process. But, we are happy to announce that it’s a common misconception that you need 20 percent down to buy a home.

Lenders are currently offering mortgage products with very affordable down payments.

If you are a first time buyer you might not be aware that there are reasonable loan options available to you. It would be great to have the 20% down payment to avoid CMHC, but having more options available to you means you can make your dream of being a home owner a reality.

Choosing an option with a smaller down payment (or an alternative downpayment) can make it possible for you to enjoy the benefits of homeownership sooner.

1) Use Your RRSP For downpayment

“Using your RRSP is easier to use then you may think. Under the federal government’s Home Buyer’s Plan, first-time home buyers are eligible to use up to $25,000 in RRSP savings per person. That means you can access up to ($50,000 for couples) for a down payment on a home.

The money you withdrawal is not taxable as long as you repay it within a 15-year period. To qualify, the RRSP funds you plan to use must have been in your RRSP for at least 90 days.

It may be wise to leverage your money and use your RRSP even if you already have enough money for your down payment. It may make sense to access your RRSP savings through the Home Buyers’ Plan and use your money you have save to finish your yard, driveway, basement, or anything else that will add value to your home and help with resale while increasing your ROI.

For example, if you have already saved $15,000 for a down payment-and assuming you still had enough “contribution room” in your RRSP for a contribution of that amount, you could move your savings into an RRSP at least 90 days before your closing date. Then, simply withdraw the money through the Home Buyers’ Plan.” RBC.

The advantage? Your $15,000 RRSP contribution will count as a tax deduction this year. Use any tax refund you receive to repay the RRSP or other expenses related to buying your home.

Before you take our suggestions, it’s always a great idea to talk to your financial planner to see if this strategy makes sense for you.

2) First Home Plan: Graduate Retention Program (GRP)

If you are, or will be, a resident of Saskatchewan, have GRP tax credits available, are a first-time homebuyer and you purchase a single-family house, semi-detached house or townhouse as your primary residence in Saskatchewan you are eligible for the GRP.

What this means is that if you and your partner are both recent graduates you are eligible to receive $10,000.00 each. That’s a total of $20,000.00. If your home purchase price is $210,000.00 you are half way to having a 20% downpayment. Or, if you choose one of the options below, you can probably become a homeowner. You must receive the First Home Plan loan approval before taking possession of your first home.

You can apply here for the GRP.

3) Low Down Payment Insured Mortgage

Did you know that you can put down as little as 5%?

Many lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages – some as low as 5%. The one downfall to a low down payment is higher monthly payments.

Low down payment mortgages must be insured to cover potential default of payment and as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you.

As a friendly reminder, Canada’s mortgage rules have changed. The rules involve a stress test for all insured mortgage applications to ensure the borrower (you) can still service your loan in the event interest rates rise or your personal financial situation changes.

Until now, stress tests were not required for fixed-rate mortgages longer than five years.

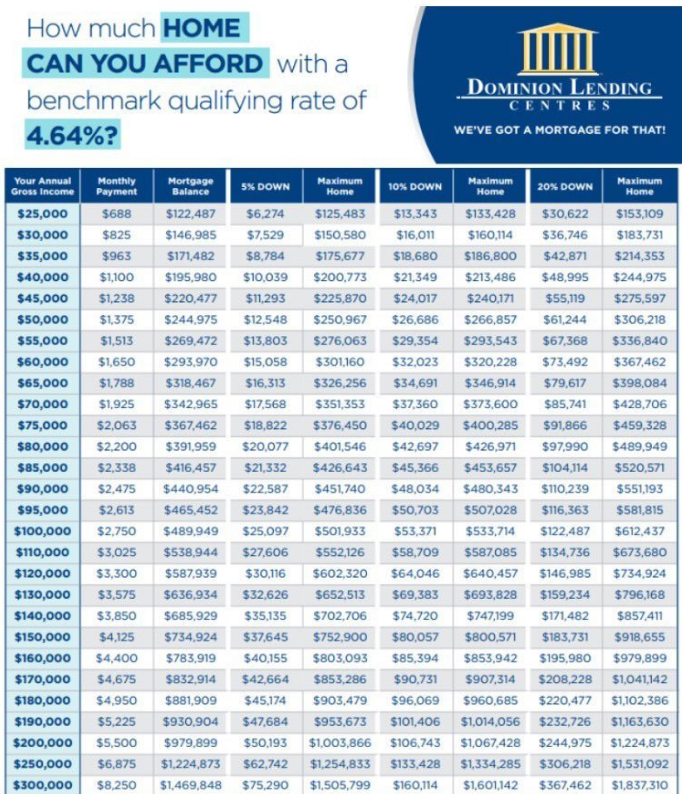

How Much Can I Afford?

If you are wondering what you can afford to purchase, we found this great resource to help you!

Huffington Post: Mortgage Rules